Career Center

The Career Center provides guidance, support, and advice to empower students in designing a fulfilling career journey.

Students

As an undergraduate or graduate student, we can help you find and connect with employers for on- or off-campus jobs, internships, and jobs for after graduation. We even have a dedicated job search board, Handshake; all current students are automatically issued accounts. Not sure what you want to do after you graduate? Thinking about pursuing a graduate or professional school program? Need tips on budgeting and managing your finances? We can help with these and other career-related questions.

Alumni

We don't forget about you once you graduate - so don't forget about us either! If you're a recent alum (within 3-years post-graduation) looking for an entry-level job, changing career paths, or applying to graduate school, we have resources available to assist with your search. More experienced alumni should refer to the Alumni Association website for job-search resources.

Learn More for Alumni

Employers

Are you a local, regional, national or global employer? We host several career fairs and employer events throughout the year. And, we'd love for you to get involved. Alumni who are looking to hire student interns and/or recent graduates should also connect with us. You know our students are amazing, so why not consider hiring them?

Achieve your goals

Meet Michael Stein '24. He's a double-major in English and Jewish studies with a minor in medical humanities. He recently interned with the Office of the Virginia Attorney General. All thanks to the Career Center Internship Award program, which provides financial support & career readiness skills.

Meet Michael

Play video

Play video

Summer Internships

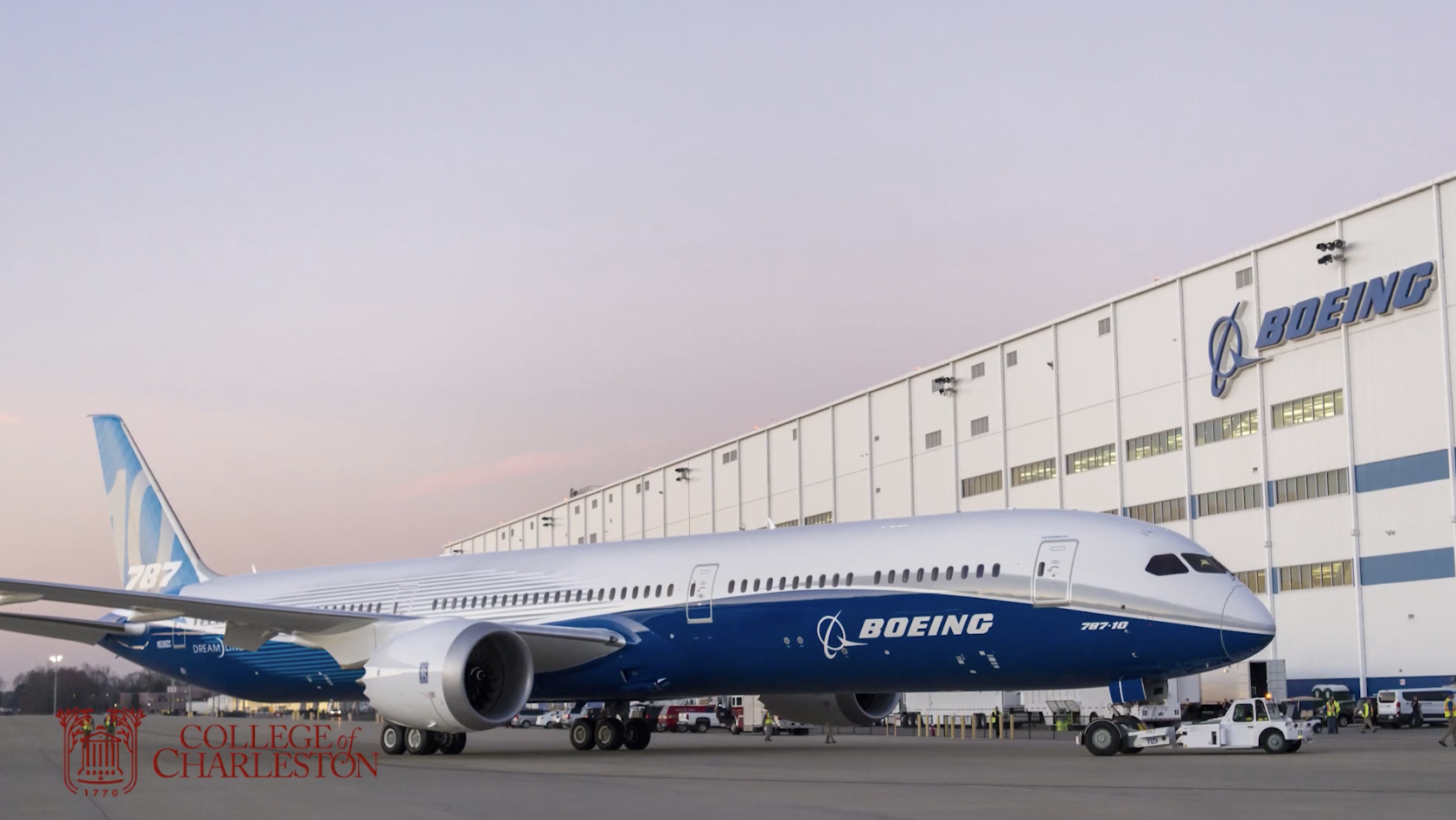

Make the most of your summer by securing a summer internship. One student shares how an opportunity with Boeing helped her learn and grow.

Watch Video